August 2023 Trends in the SLED IT Market

A Predictably Slow Summer Gives Way to a Promising September

Trying to crack the state, local and education (SLED) IT market? Maxwell Heinemann sat down with David Heinemann, SVP of State & Local Government Research and Strategy at GovExec, to get his insider advice for technology vendors serving State and Local governments. Following a predictably slow summer – people are on vacation – September looks promising.

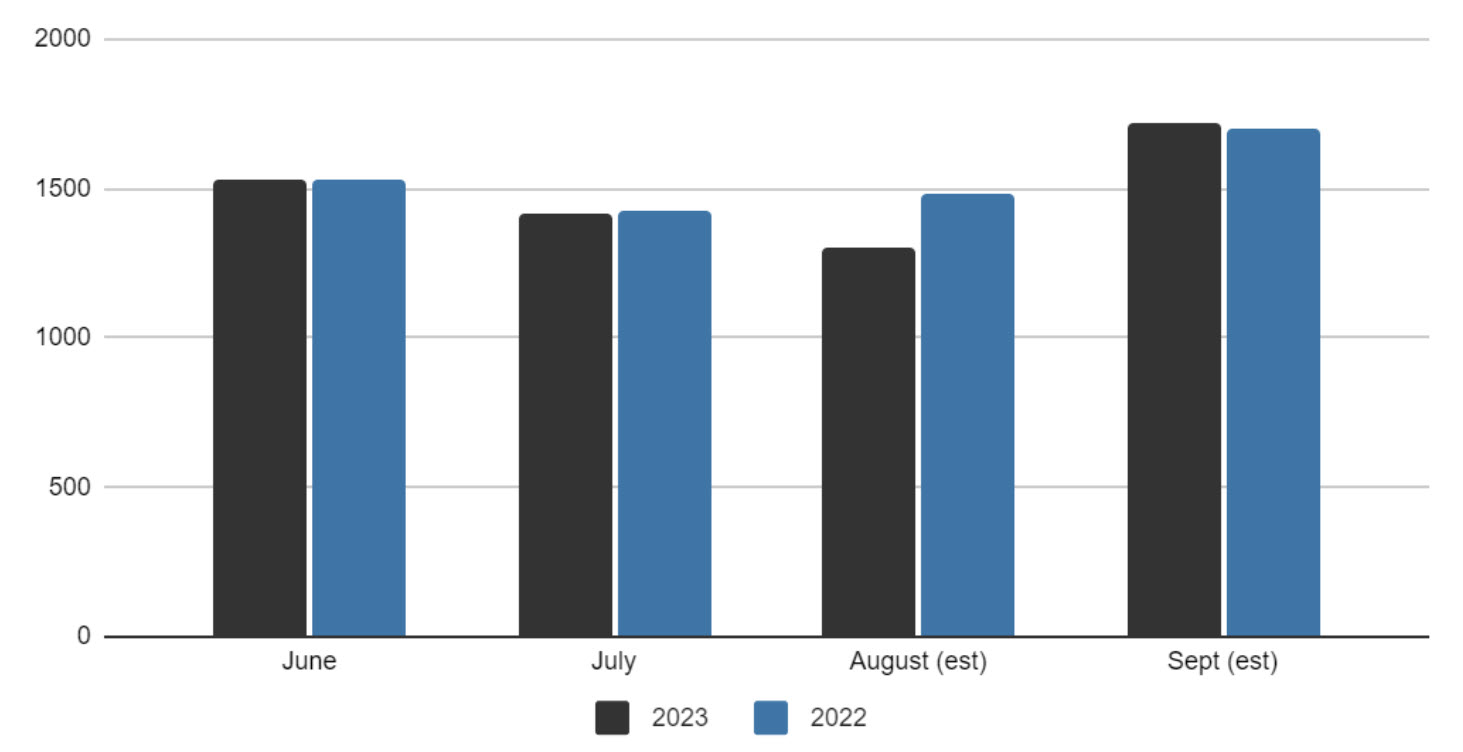

Overview of Q3 Procurement Activity in SLED IT

Q. Overall, what’s the best way to approach the SLED IT market?

Q. What procurement trends are you seeing for August 2023 in MarketEdge’s data?

David: Here are some of the key trends I’m seeing:

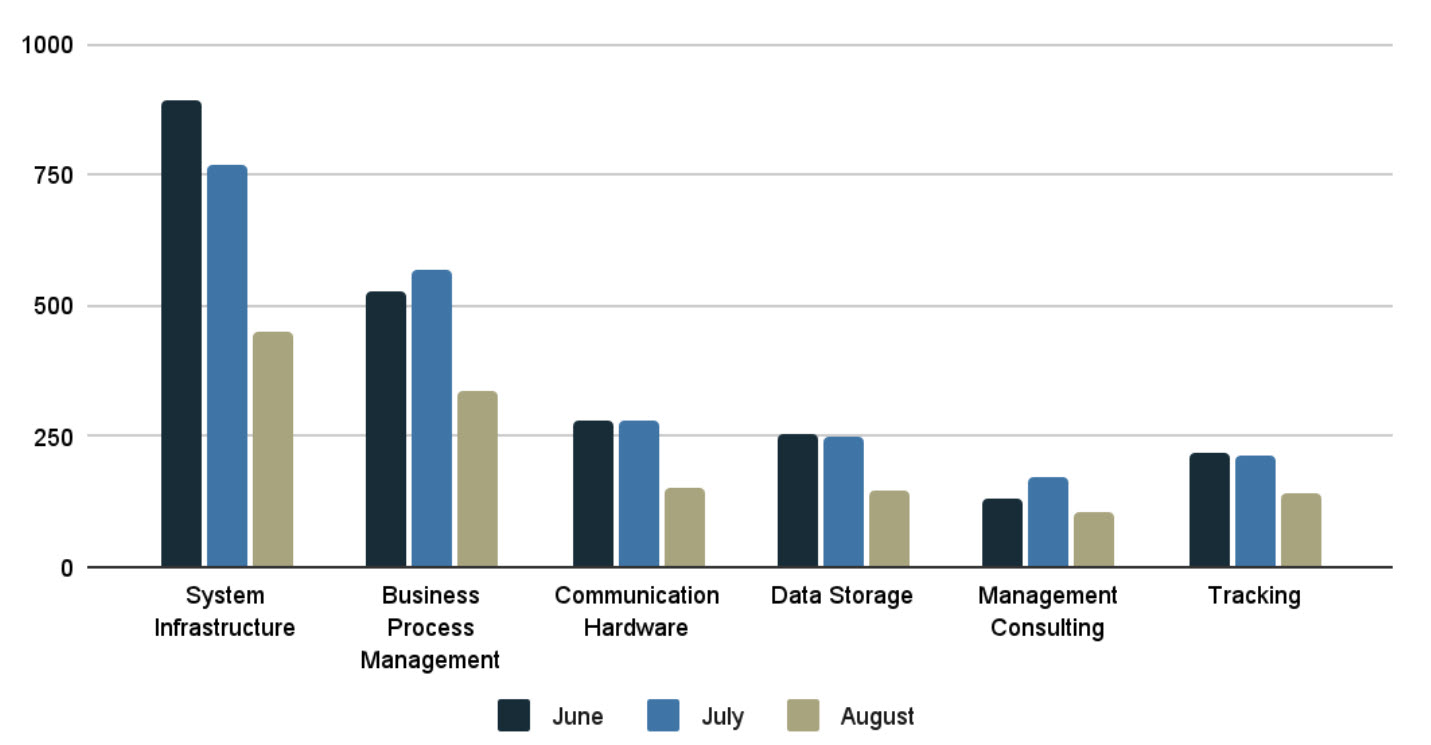

- Infrastructure spending remains strong due to funding programs like the IIJA, so system infrastructure is a major procurement category.

- Artificial intelligence adoption is increasing, with many RFPs now referencing using AI for data aggregation and analysis.

- There is some uncertainty around federal funding levels beyond 2024, so I expect accelerated spending on current projects while funding is more certain.

- Software-as-a-service (SaaS) continues to gain momentum over capital expenditure for software purchases.

- Cybersecurity and data privacy are top concerns due to ransomware threats, so security-focused solutions resonate.

- Digital transformation continues across SLED as governments seek to provide more online/mobile services and make data more transparent.

- Vendors should listen directly to buyer needs versus just relying on past trends, as emerging priorities can arise.

In summary, infrastructure, AI, security, SaaS adoption, and digital transformation seem to be some of the key trends and focus areas in the SLED IT market.

Q3 2023 Largest Number of RFPs by Tech Category

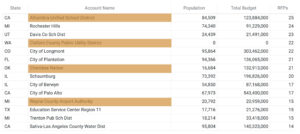

Q: Where should new vendors look for their first SLED IT opportunities?

David: Don’t just focus on the large jurisdictions. Smaller agencies and special districts are increasingly active in IT as it expands across government functions. Monitoring their buyer signals and pain points can uncover great prospects flying under the radar.

Most active SLED IT jurisdictions in August by # of RFPs

Q: Why is it so important to engage SLED buyers before an RFP is issued?

David: RFP response windows are tight, so getting in early is key. It allows time to shape requirements and position your solution. Our research shows buyers start exploring solutions up to 2 years before issuing RFPs. Identify needs early to get a head start.

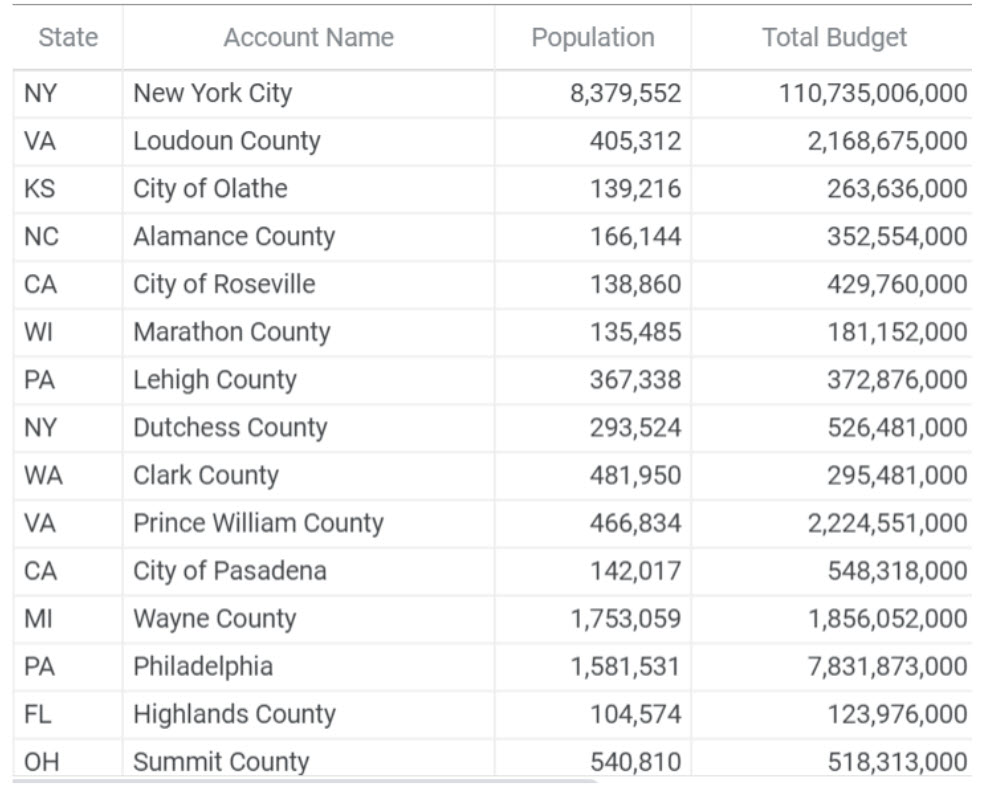

Q. What should vendors know before approaching accounts?

Q: What’s the value of using intent data to identify prospects?

David: With limited time, focus outreach on those demonstrating active interest. We capture over 4 million anonymous SLED buyer signals monthly across our media properties, revealing real-time research behavior. This filters prospects farther along in their journey.

Most Active SLED IT Jurisdictions in August by Buyer Intent Signals

Q: How could changing federal funding impact SLED IT projects?

David: Infrastructure remains a priority thanks to funding programs like the IIJA. But future uncertainty beyond 2024 may accelerate current projects while funding is certain. Vendors should track flows to capitalize on active periods.

Q: What technology trends do you foresee in SLED?

David: Solutions addressing heightened needs like security and AI integration will continue to resonate. But vendors should listen directly to buyers to identify emerging priorities.

Conclusion

David offers invaluable guidance for approaching the complex SLED IT market:

- Look past major jurisdictions at smaller, active agencies

- Engage early, as buyers research solutions long before RFPs

- Use intent data to identify promising prospects

- Track funding trends to capitalize on active periods

- Adapt to shifting buyer priorities

- Focus on high-demand technologies like AI and SaaS

Though competitive, nuanced targeting and early engagement can uncover real opportunities. Vendors who listen to emerging needs and stay nimble will thrive in this evolving market.

Sign Up for the WeeklyEdge

Every Monday we’ll deliver active State and Local government accounts to your inbox that our proprietary AI identified for you based on the keywords that you care about.

Get Your WeeklyEdge